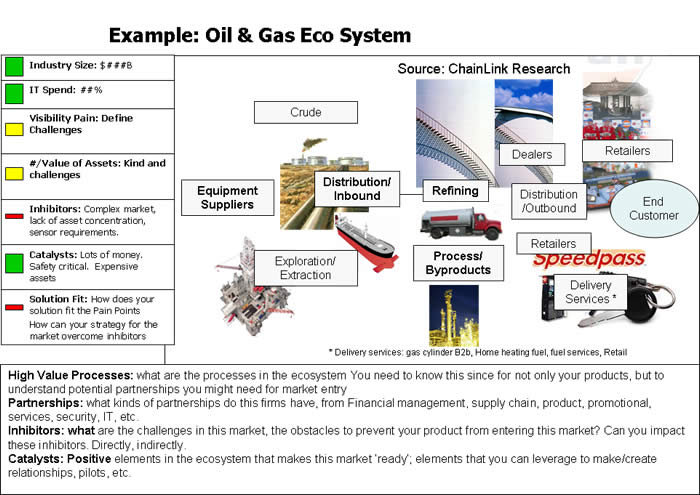

ChainLink has recently done extensive research on the global business perspective, focusing on major industry supply chain ecosystems, identifying the pain points as well as the catalysts and inhibitors of adoption of policy, process and technology changes.

A series of burning questions plague both buyers and sellers. When will X technology, my product sector, take off? And how will it happen? What markets and processes will be adopted, how much will they pay; how low will prices have to go, before we have world wide implementation? Burning issues, no doubt, for many.

If you are a Supply Chain guy, a commodities buyer, or a transportation carrier, you might be wondering the same thing. What will be the price of energy, for example?

If you are a Supply Chain guy, a commodities buyer, or a transportation carrier, you might be wondering the same thing. What will be the price of energy, for example?

The old adage: “a hint to the wise is enough”. Well, we have many hints to apply here. But since we don’t have much space in an article to lay out the whole model, we will provide the higher level. Obviously, we have the deep research on these.

Here is some sage advice for end-users and tech companies:

Our Voyage of Discovery

There are different kinds of research companies. Some are product focused, (will users like the taste of this, will this technology product be well received.) The others, like ChainLink, look at broad economic and strategic issues. With that simple differentiation in mind, this allows me to arrive at the point of this article.*

We call it our Discovery Process. We have a research model that we apply to specific technology, or business sectors, from payments systems/financial services, to supply chain, to Franchise models, to RFID. These are just examples. These approaches have merit if you are a Wall Street researcher, a commodities manager, a Chief Risk Officer, Supply Chain Manager, or a Chief Marketing Officer.

We looked at twenty industries. How did these industries work amongst themselves? What are their challenges? How did the companies in these industries form ecosystems to achieve their ends? What key processes operated within these ecosystems, from Supply Chain, Human Resources, to Financial Service Models, Collocating of Service and Franchise relationships? Out of these we derived a view of the most problematic issues in these ecosystems—Pain Points. And then, what technologies and processes could address these problems? What inhibitors are in these markets to prevent establishment of my process?

That is the high level, of course. A lot more is needed to arrive at good answers, specific answers, for your endeavor.

You have to be patient with this type of research and understand how to create and work with the data. And preconceived notions don’t help, the so-called Research Premise. Paradigm operatives "I only see what I am looking for" does not help get to real issues and causal. These issues are well understood by scientists and not often applied;

in Pharma and Biotech, for example, the research can be too focused on a process—will this compound solve X problem, but it turns out it solves Y problem instead, yet you totally missed it. Or the math is great, but there is no corollary to the actual physical world. String theory, anyone?

You can launch surveys (we do all the time). For example, you look for: "How much, how many, why not, and did you"? They are really good indicators of the known questions. But how about the unknown? You have to talk to many people at many levels, globally, and then sort through “I wish it were so” to the “and that’s the way it is”. So, performance data and lots of number crunching is key, too, as well as observable emersion.

One View

Looking at ecosystems is critical in adoption of any process that requires participation from your trading partners. Payments systems, for example. EDI and Bar-coding adoption continue after 20 years. This past summer I visited an extremely reputable company that had just implemented bar-coding with their suppliers—2006! And the market is still wide open to get compliance on simple things like the humble Advanced Ship Notifications, one of the most useful and simple to implement EDI signals!!

Pink shorts. You might want to make them, but will your retail partner want to sell them? Or, say, smart shelves. Technology works, but is it really going to work and get used in the warehouse, store, hospital, and for what price point does the ROI kick in? Sometimes you find that the market you were looking for is not that good a fit, but an even bigger opportunity lies within the ecosystem. This ecosystem analysis lets you find that. So, who really are the key decision makers in those ecosystems?

And of course there is Supply Chain, which requires an onboarding and ongoing co-management process based on a rich set of agreements (Policies) and Process, data, etc.

End-user: Say you are a procurement manager, buying commodities. You really need to think, on an ongoing basis, about what is going on in my supply markets. Who might be entering those markets and gobble up scarce resources? And more….

- New Customers for service or product providers

Who are the distribution channels, how can my product get in their catalogue?

- Technology Providers

Market entry: What kind of approaches do I need to enter these markets? Who are the key companies, buyers? What is the value proposition I can pitch?

Inhibitors and Catalysts

Many markets may have many inhibitors to your strategy.

Many of these issues are global in scope, many are on the ecosystem level, and then some are just those darn customers. ( We won’t address the latter.) The issue is, can I affect them? Can I create a positive outcome? Or can I gather the players together, and forge an alliance to solve these?

Here is the value of industry groups. Big sometimes helps. Again, you might have to be the catalyst here, yourself.

Having been part of the team that worked on two major historical events like this—getting a whole ecosystem to focus on a new game-changing idea, standards and technology, I can tell you that it can be done. But who you are in those ecosystems and who you ally with, of course, is critical in the game. (Certainly this topic is worth a huge treatise, but no space here!)

Having been part of the team that worked on two major historical events like this—getting a whole ecosystem to focus on a new game-changing idea, standards and technology, I can tell you that it can be done. But who you are in those ecosystems and who you ally with, of course, is critical in the game. (Certainly this topic is worth a huge treatise, but no space here!)

Catalysts need to be strong as well. Has that soil been softened for seeds? Are they strong enough? What stage of understanding are potential buyers at? Do you have the right/accurate language to describe

what you are looking for? Does the right partnership make the difference here?

This is also true, for example, in entering, as we all know, geographic territories. Can I enter, say, the Japanese market and be successful? Or the Retail market?

The bottom line truly is what can be done, and when to impact these inhibitors. Can I impact them? Are the catalyzing forces strong enough to overcome them?

Economic Models:

One of the things we look at a lot is deal sizes. Think about it. Anybody can give away a product. That is not sales! So, if the financial model is not built upon a model where you can make money, you have a huge problem. Are your product creation processes too expensive? (COGS) Have you priced your product too low in order to gain, you believe, some market traction? You might have an unsustainable model. The thing about prices is, they don’t go up.

So, if you think you are going to win the Wal-Mart deal by lowering the price of your pickles below the Manufacturing cost, that is a strategy for going out of business; or low ball your logistics costs; or low ball your software costs; or low ball your RFID device or software costs.

That gets back to ecosystem maps: who values what I do, and how much pain are they really in? Have I effectively differentiated myself to gain the customer and a decent sustainable price, and maybe even a premium (avoiding commodity hell)?

That gets back to ecosystem maps: who values what I do, and how much pain are they really in? Have I effectively differentiated myself to gain the customer and a decent sustainable price, and maybe even a premium (avoiding commodity hell)?

We see too many wishful players not really addressing these other issues to create a right Market plan, and a sustainable plan. One market might not be right for you. Look at both your assets and value. Who best can use them? Another vertical, another supplier might, surprisingly, be the right one for you!

These are just some elements we use to arrive at our research results. We thought that, entering a new year, we would share them with you.

* We use these in our Research and will have a report summarizing these this year.